You may know, that I have helped a lot of businesses from all kinds of industries all over the US and Canada. A lot of these clients were operating around the Break Even Point which is actually fairly natural given the ways that the market space works.

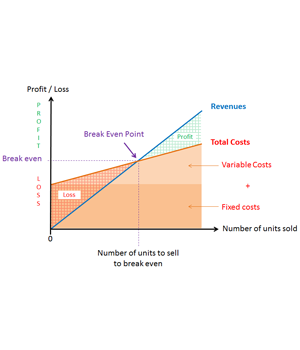

I have recorded a video on the Break Even Point. It’s a Graphical Presentation, that shows you what I’m talking about.

Many of these clients I help have a profitable business, yet they always seem to really struggle with their cash, always walking on the edge trying to balance enough cash coming in to pay off and meet their obligations.

If you have ever been there you know the terrible sensation that brings you. Being an entrepreneur and a business owner, I bet you know that sensation. You may be there yourself right now or more than likely at least, you have been there at one point or another.

What a lot of my clients who live such reality are failing to understand has a lot to do with not either knowing of the Break Even Point dynamics or of what the implications truly are of these dynamics.

One client comes to mind. This client has service engineers that perform a lot of the work that ultimately makes up the business. This work is highly critical for it is basically this service that is being sold.

Now, at the time I commenced working with the client, he was operating right at his break even point. He was making a small profit, and had a growing business. However, he was constantly struggling with cash till I began working with him. In fact even a $300 monthly obligation would get him terribly worried.

The phone was ringing off the hook in his business and more potential new customers wanted quotes. It was evident with the reputation and great work of his business there certainly was amble amount of revenue potential beyond what the business currently made happen.

His capacity in the business, however, was severely crippled and limited. He quite simply had too few people to handle and carry out the services. In fact, he himself would have to be out there in order to meet the time lines of the customers and get all the services done.

Here’s the thing.

If he had truly understood the dynamics of the Break Even of a business, he would quickly have found that his troubles would actually quickly be over.

This really is explained in the video of your program called Break Even – A Graphical Presentation. You see, once you begin to move past your Break Even Point, you begin to reap the benefits of extra cash actually materializing in your business.

The reason is, as also explained in the video, that you have now already met your fixed expenses, so now for every extra unit you sell, you will reap the extra cash stemming from the gross profits of each of those extra units.

For sure he needed to hire extra people and it would surely also relieve himself of having to carry out a lot of the services himself, so he would have had more time to work on the business instead of in the business. But he was scared that he just couldn’t afford hiring the extra people.

Now, I get it.

When you are struggling with your cash, you are too nervous about expanding your obligations including not least hiring more people. Even if it seems you need the extra hands in your business, you are scared that there won’t be enough money to go around to pay for it.

So we sat down and we looked at how many service hours he would have to bill for and collect money for in order to at least meet the pay and other associated expenses for each new individual that he would hire as a service engineer.

Guess what.

The amount he calculated under my guidance was surprisingly low. So low in fact that all he would need to sell and collect for on a daily basis, was a measly 2 hours per day per service engineer!

With phones ringing off the hook with more business, and with the new orders he took in, which he would postpone the actual delivery of for up to 2 months, there certainly was plenty of billable hours of work available in the pipeline.

But he was so accustomed to the fact that, he had cash tightness and always felt he had to juggle the limited cash around in order to keep everybody happy and meet his obligations. So he just didn’t dare pull the trigger on hiring more people. His thoughts were that he probably still couldn’t afford it.

If you are in this situation, and you are worried about an expense you have to meet of $300, then imagine that you would make a relatively simple change in your business, and you would have an extra say $1,000 coming in a week.

How would that make you feel?

That’s right. That changes the picture and daily reality very, very quickly.

Things soon eases up and life becomes so much better.

Then from there, you of course will gain more time and attention to be able to focus on running your business instead of the business running you, and then begin to make much more money looking at all the other parts of the business you also could not see or did not have the whereabouts of.

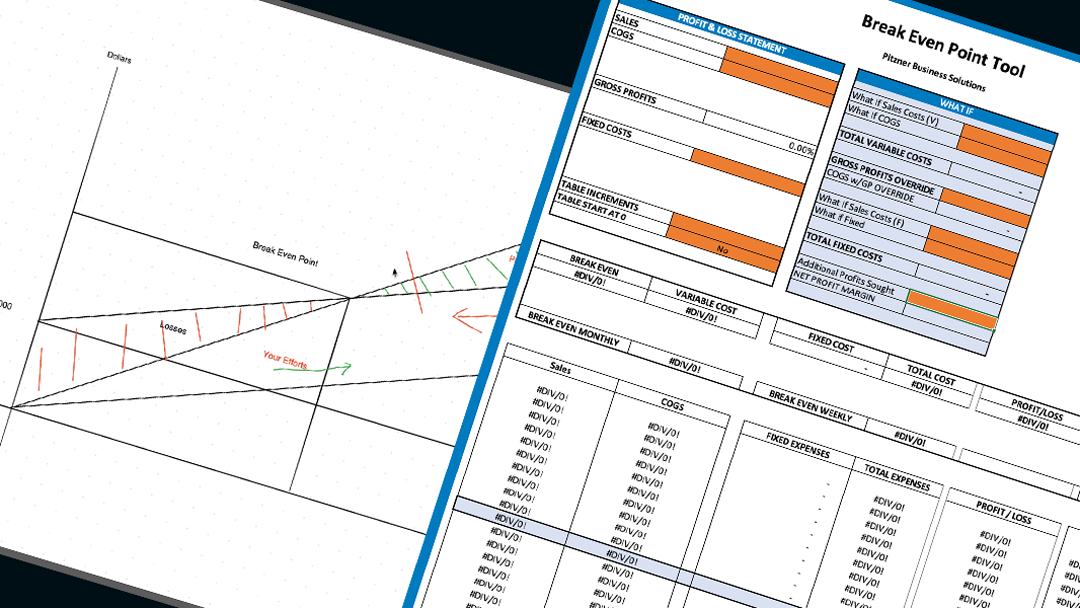

Now, some of you may be in much better cash positions with your business already. I created a tool that is extremely helpful too. The tool not only can calculate the break even point in mere seconds, but it also gives me really fantastic insights into what will happen in my business if I make a change here or there.

With the tool you can play around with several “what if’ scenarios, and see what the effect will be. Once you begin to do so and stop up and think about the implications, you will be in a much improved position to make decisions on a much more educated basis.

The benefits of this, including the insights that you can gain of where you may wish to put greater focus into or implement changes first, can help you make more money, oftentimes much more money, with your business.